I received some good feedback on last week’s email, so I thought I’d send you some more of my thoughts from the weekend and yesterday. Please let me know what you think about this week’s note below. Feedback is greatly appreciated. If you’d like to be removed, just reply and tell me…

First, my subject line is a bit misleading – I don’t really have a coupon for you – but with the recent decline in crypto pricing I feel like I do. As I write this, Bitcoin is back under $43,000, Ethereum is just barely over $3,000, and the alt coins are mostly down too. I’m treating this like a sale or a coupon – it’s a buying opportunity. The Solana outage, concerns that The Evergrande Group might default on debt, the US regulatory focus, Coinbase backing off its LEND product as well as other events were all pointed to as possible causes for the drop in crypto prices. These events may or may not cause the recent dip, and we still have the big options expiration for BTC and ETH this Friday which may result in a bit more dip. With all that, I see these as temporary influences on crypto pricing. I haven’t read anything yet that changes the fundamentals of crypto currencies today.

Last week I told you that I remain bullish on crypto and expect new all-time highs by year’s end. I maintain that confidence and continue to purchase more crypto. If you’ve been thinking about getting started in crypto or expanding your positions, now might be a good time to do so. I am happy to share my thoughts and what I’m doing, but this is not financial advice for you. You need to evaluate your own situation and risk tolerance and as always it’s important to DYOR (Do Your Own Research) and not put any money into crypto that you are not willing to lose.

Next, I received a tweet with a ‘whale alert’ about someone who moved 7,610 BTC ($317M) for a transaction fee 0.00002024 BTC ($0.85). I confess I was a bit curious and looked on the blockchain to see the addresses where that large sum was coming from and going to. You can look too if you are interested. Now aside from the financial voyeurism, why do I mention this to you? First that compared to other methods of major money transfers (SWIFT network and other variations of wiring money) the costs are insanely low. Also, to remind you that Bitcoin and most cryptocurrencies are on a public distributed ledger so all the transactions are publicly viewable. If it is this easy for you and I to look at the ledger and see the money moving, how much information do you think the IRS and DHS (Department of Homeland Security) and the other three letter agencies can pull from this public record? Why does this matter?

- Many people think (erroneously) that crypto transactions are anonymous. While your crypto address may not be ‘registered’ to your name or SSN, with a bit of work, most addresses can have their owners identified.

- US citizens who do not report crypto transactions as required are at risk for being caught by blockchain analysis. The IRS is definitely looking to step up enforcement of this.

- If you are buying and selling crypto you need to track your trades carefully, so you can report your income appropriately. If you do more than a handful of trades, I strongly suggest using a service or software designed specifically for tracking crypto transactions to keep it all straight.

- There is increasing interest in privacy coins such as Monero (XMR), Pirate Chain (ARRR) and HUSH as well as privacy services such as the BLANK wallet, RailGun smart contracts (anonymous transactions over ETH networks) and coinmixing services. I believe this interest will result in greater demand and prices for these coins and services, but it is also possible that they will get increased regulation and scrutiny which could reduce demand and pricing.

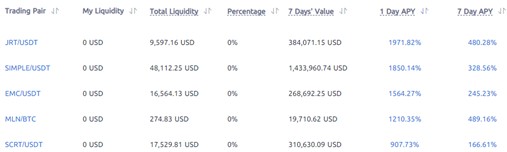

Finally, one of the projects I follow (Pirate Chain – ARRR) just released the opportunity to use its crypto in DeFi via liquidity pools. I expect this will increase the visibility and demand for ARRR as it makes it easier for more people to purchase / use. I appreciated their developer comments during yesterday’s Ask Me Anything session – specifically that you shouldn’t put too much emphasis on the potential APY available. These rates are almost all variable and as more people participate that rate can come down dramatically and quickly. Having said that, for people willing to take the risk there are some potential high rates of return that are offered. To give you an idea of what is out there, here are the top 1 day APYs I saw on an exchange yesterday.

We are still early in the crypto cycle and now is a great time to get in and learn how it all works. I have participated in a number of DeFi offerings and have gotten some amazing returns on some – as well as lost money on others. If you or anyone you know would like to learn more, that is one of the consulting packages I offer.

I enjoy answering your crypto questions, so feel free to email me or call me, I like to help. Personal instruction and assistance is my specialty – I offer one on one consulting on any crypto topic as well as a number of consulting packages.

Thanks,

Jesse